Answer : TTA has established a policy to distribute dividends of at least 25% of the consolidated net profit after tax but excluding unrealised foreign exchange gains or losses, subject to the Company’s investment plans and other relevant factors. The Board may review and revise the dividend policy from time to time to reflect the Company’s future business plans, the needs for investment, and other factors, as the Board deems appropriate. However, dividend distributions may not exceed the retained earnings reported in the separate financial statements of the Company.

Answer : As of 26 September 2025, TRIS Rating adjusted TTA’s company and senior unsecured debenture ratings to “BBB” with a “stable” outlook. The rating are supported by TTA’s solid financial metrics with low leverage and sizable cash reserves. The ratings revision reflects TTA’s strengthened balance sheet supported by strong cash flow from operations and conservative dividend payment. We expect TTA’s dry-bulk shipping business to continue delivering sound operating performance in the near term with favorable supply and demand dynamics, and its offshore service business to turnaround with a strong orderbook and growing scale of operations.

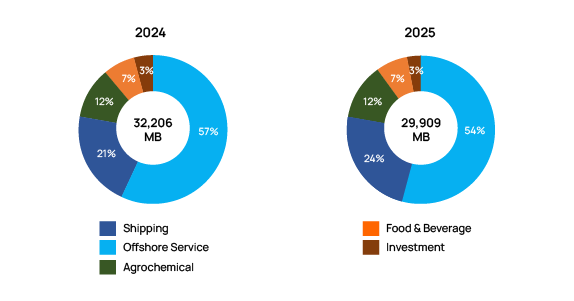

Answer : TTA is a holding company that invests in other companies through shareholding. TTA’s strategic business portfolio is categorized into 5 business segments as follows:

- Shipping trades under the brand name “Thoresen Shipping”, which is an internationally acclaimed participant in the global dry bulk markets with roots going back over 110 years. Thoresen Shipping is 100% owned by TTA.

- Offshore Service provides subsea service such as Inspection, Repair, and Maintenance (IRM) work. Mermaid Maritime Plc. (“Mermaid”) is a flagship company, of which 58.2% of total paid-up capital is owned by TTA. Mermaid is a Thai company listed on the Singapore Exchange (SGX).

- Agrochemical produces and distributes fertilizer mainly in Vietnam under the “STORK” trademark, registered in Vietnam since 2005 and highly-recognized and credited for quality and reliability. This segment is represented by PM Thoresen Asia Holdings Plc. (“PMTA”), a listed company on the Stock Exchange of Thailand (SET). TTA owns 68.5% of its total paid-up capital.

- Food & Beverage has 2 brands under management. Pizza Hut is operated as a 70%-owned subsidiary of TTA, the only Pizza Hut franchisee in Thailand. As of 31 December 2025, there were 214 outlets nationwide. Another brand is Taco Bell, the leading American restaurant chain serving a variety of Mexican inspired food, is operated as a 70%-owned subsidiary of TTA. As of 31 December 2025, there were 45 outlets nationwide.

- Investments comprises of all other businesses, which are not categorized in the above four core businesses. Some examples are water, and logistics including port and warehouse services.

Answer : Approximately 90% of total revenues came from Shipping, Offshore Service, and Agrochemical Segments. In 2025, total revenues were recorded at Baht 29,909 million. Shipping, Offshore Service, Agrochemical, Food & Beverage, and Investment contributed 24%, 54%, 12%, 7%, and 3% to the consolidated revenues, respectively.

Answer : As of 31 December 2025, Shipping segment owned 23 vessels (21 Supramax and 2 Ultramax) with an average size of 56,228 DWT and an average age of 16.9 years.